Renters Insurance in and around Saginaw

Saginaw renters, State Farm has insurance for you, too

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Home is home even if you are leasing it. And whether it's a townhome or an apartment, protection for your personal belongings is good to have, even if your landlord doesn’t require it.

Saginaw renters, State Farm has insurance for you, too

Rent wisely with insurance from State Farm

State Farm Has Options For Your Renters Insurance Needs

Many renters underestimate the cost of replacing their belongings. Your valuables in your rented apartment include a wide variety of things like your cooking set, smartphone, video game system, and more. That's why renters insurance can be such a good choice. But don't worry, State Farm agent Karl Briggs has the efficiency and personal attention needed to help you choose the right policy and help you keep your things safe.

Don’t let concerns about protecting your personal belongings stress you out! Reach out to State Farm Agent Karl Briggs today, and see how you can save with State Farm renters insurance.

Have More Questions About Renters Insurance?

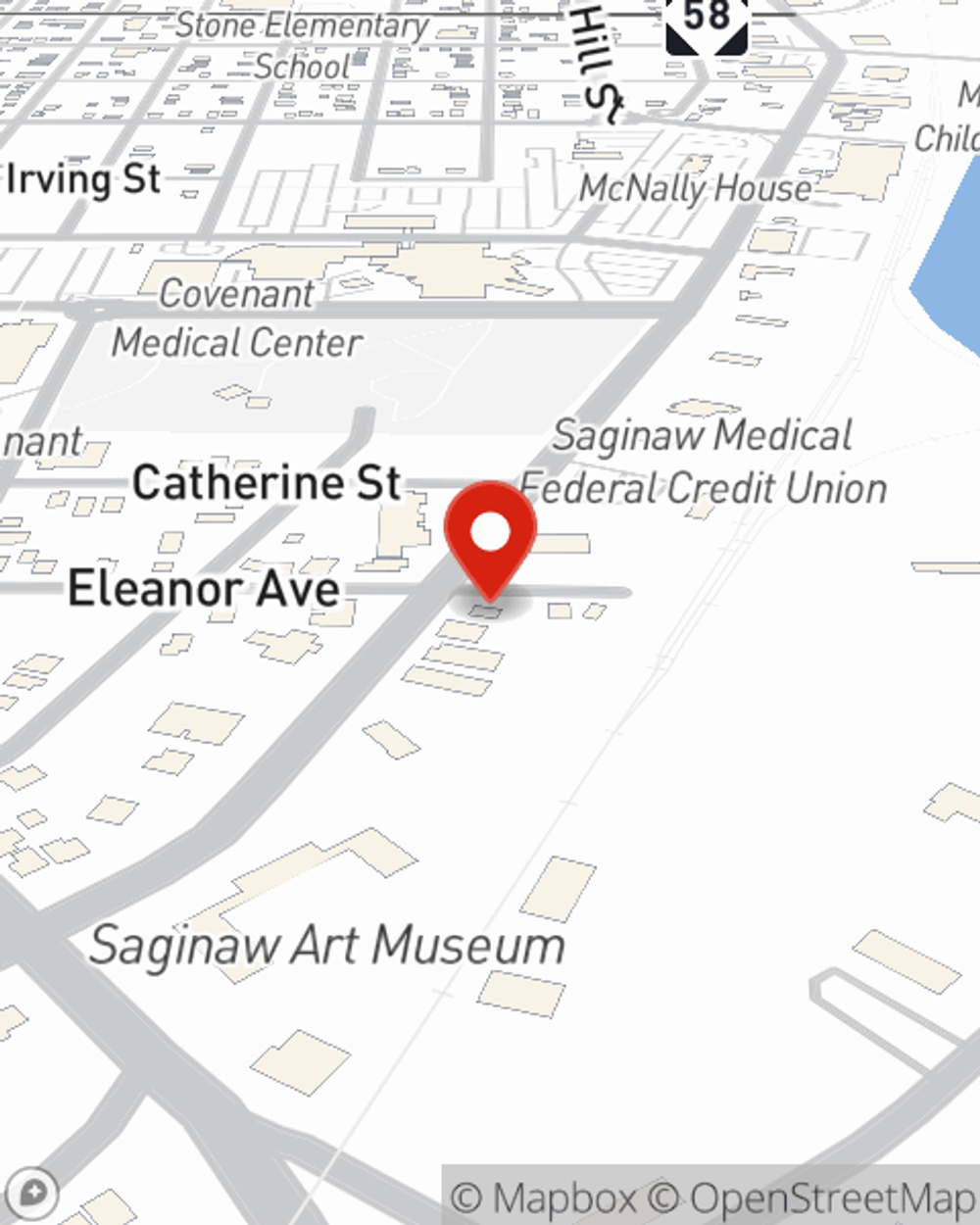

Call Karl at (989) 755-4451 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

Karl Briggs

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.